Spending on Nondurables is Tanking Despite Wage Growth

I don't know if it is good news or bad news, but it is certainly important. People have more money in their pockets. They are spending most of it. However, they are buying services, and their spending on goods has started to drop in absolute terms.

This is important especially to the people who make nondurable goods and you will see why below.

Much of it is probably deflation in gasoline pricing, if it is, it means there will be fallout in services when gas prices rebound.

Friday, March 27, 2015

Sunday, November 2, 2014

Do Gasoline Prices Nosedive Before Elections?

I have heard quite a bit of chatter about the price of gas always dropping before an election. I wanted to see for myself. The results are quite interesting. It looks like prices go down during election seasons. As you can see in the third graph, they also go down during non-election falls as well.

As is the philosophy at ExPed, see for yourself!

As is the philosophy at ExPed, see for yourself!

Sunday, February 17, 2013

Saturday, January 26, 2013

Could Be Time To Buy or ReFi Your House

We all believe Mortgages under 4% will not last forever. If you have had the self discipline to wait for the very bottom of the mortgage interest rates now may be the moment. Interest rates have been going sideways for a few months. This is coupled with what seems to be growth in demand.

Sunday, January 20, 2013

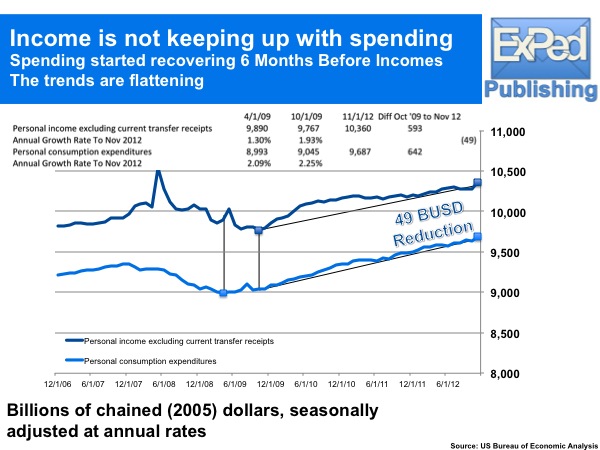

Income is important

A quick look at the daily report from Friday shows real disposable income is gaining more than it is losing over the last months. When you look a little deeper, we are not in the clear yet. Growth in real consumption expenditures is growing faster. This is supported by the steady growth in installment credit.

Until incomes firm up, the real economy will have a hard time sustaining growth.

Until incomes firm up, the real economy will have a hard time sustaining growth.

Subscribe to:

Posts (Atom)